blog post List

17 Stock Chart Patterns All Traders Should Know

- How the Ascending Triangle Pattern Works

- Symmetrical Triangles Work

- How the Descending Triangle Works

- How the Bump and Run Reversal Works

- Cup and Handle Pattern Works

- Double Bottom Pattern Work

- Double Top Pattern Work

- How the Rising Wedge Pattern

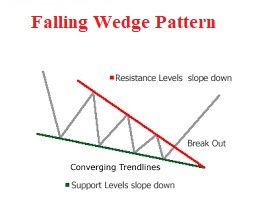

- How the Falling Wedge Pattern

- How the Flag Pattern Work

- How the Pennant Pattern Work

- How the Head and Shoulder Top

- How Inverse Head and Shoulders

- How the Rounding Bottom Pattern

- How the Price Channel Pattern

- How the Triple Top Reversal Pattern

- How the Triple Bottom Reversal Works

- Top Benjamin Graham Quotes on Value Investing

- How to buy the dip in stocks

- What are dividend Stocks

- What are bonus shares

- 20 Profitable Stocks With Low PEG Ratios

- What drives the stock price

- PE Ratio Formula

- Diff bonus issue and stock dividend

- How to read a cash flow statement

- How To Buy Shares For Beginners

- What is Demat & Trading Account

- Growth stock vs Value stock

- Basic Fundamental Analysis

- How does the stock market work

- Types of Fundamental Analysis

- How to choose strike price

- Best stock to buy for long term growth

- What is bonus shares issue

- What is diversification in investing

- Cyclic Stocks and Non Cyclical Stocks

- Penny Stocks Pros and Cons

- How to Find Good Dividend Stocks