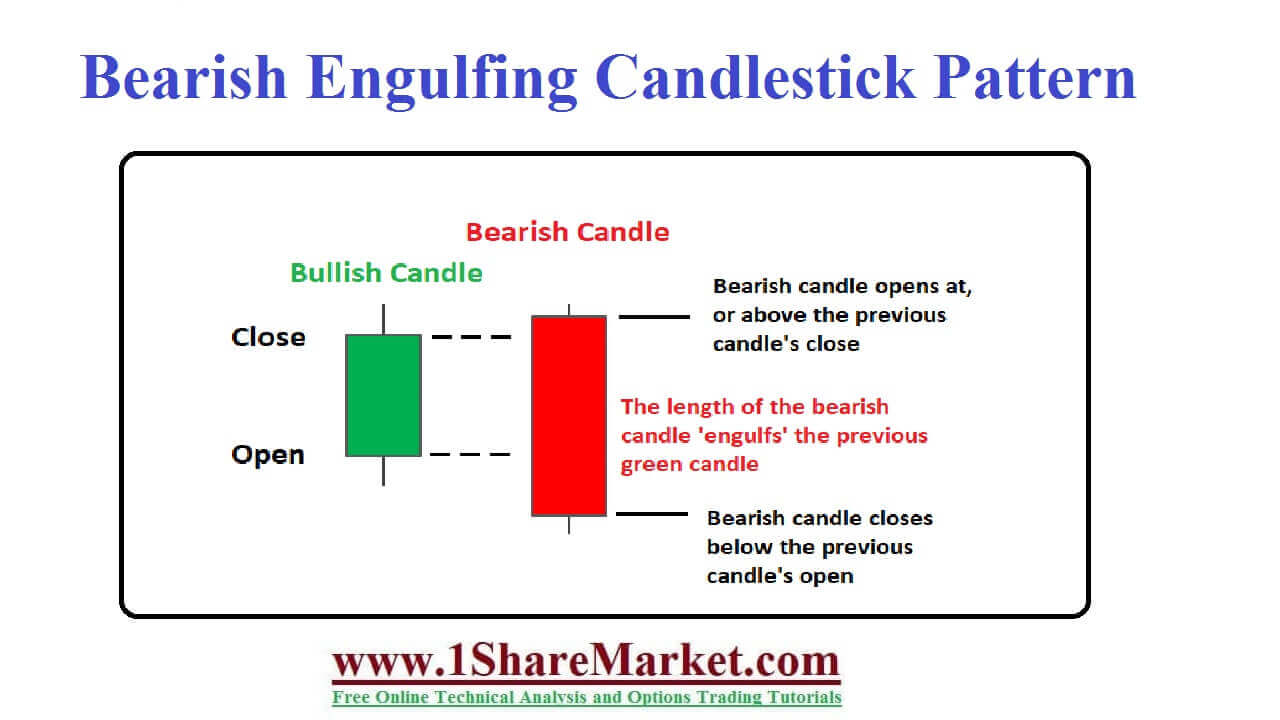

The Bearish engulfing candlestick pattern is a technical chart that signals that will lower the price. It consists of up candlestick by large down that engulfs smaller candles. The pattern is important because it will share the sellers that overtaken the buyers and are pushing the price. A bearish engulfing is at the end of an upward price when moved. The overtaken engulf by a second candle that indicates a shift toward lower prices is marked. The pattern has the reliability that opens the price of engulfing candles that go above the close of the first candle. Engulfing is an important bearish reversal pattern as it appears after an uptrend. It has two candlestick patterns as the large black candle completely engulfs the preceding small white candle. It is not necessary for the black candle to engulf the shadow of the previous white candle. It should engulf the real body with the volume on the second day that will create a higher probability of reversal. This pattern occurs in the candlestick chart of a security when a black candlestick engulfs the small white candlestick from the period before.

The pattern is created by interpreting the data of two complete candles. The first candle will depict the end of the trend strength. The size of a bullish candle varies but it is crucial body gets completely engulfed by the candle. The second candle in the pattern is called a reversal signal. This candle is consisting of a red candle creating fresh downward price momentum. This bearish candle should be open above the close of the previous candle and close below the low of the previous candle. The downward movement reflects the seller buying strength and proceeds to fall in price. It comprises two bar charts on a price chart and indicates a market reversal. These candles are popularly used to determine the market is experiencing upward or downward pressure. The candles as lagging indicators occur after price action and require the previous two candlesticks.

The bearish engulfing pattern is a bearish reversal pattern and sellers are in control. As large bearish engulfing is the pattern is also large. It is not isolation because it doesn’t go short. It identifies the reversal and forms a part of technical analysis and used as a part of a forex strategy. They will provide quick indications of where the market price might move, which is vital in a volatile market.

view moreThe bearish engulfing candlestick pattern is easy to spot and interpret.

Bearish engulfing patterns are useful to clean upward prices that move as the pattern that shifts in the downside. The engulfing may also be huge as it can leave a trader with large stop loss if they opt to trade the pattern. The establishment of potential rewards can be difficult with engulfing patterns as the candlestick will not provide a price target.

A pattern occurs after a price moves lower and indicates a higher price. The first candle is a two candle pattern that is a down candle and then the second candle is a larger up candle with a real body that engulfs the smaller down candle. Bullish engulfing is the opposite of the bearish engulfing pattern as discussed. It appears in an uptrend as at the bottom of a downtrend and presents traders with a signal to go long.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India