The bull put spread option strategy consist of one short put with a high price and one long put with a low strike price. So both have the same underlying stock and expiration date. The bull put spread is invented for credit and profit from the rising stock price. A bull spread is called a difference between the two strike prices. It is created with 1OTM Put and 1 ITM Put option. Investors use the put option to get profit from a decline in a stock price. The put option gives the ability to sell a stock at the expiration date of the contract. Investors will pay a premium to purchase a put option. They are used when the investor expects a moderate rise in the price of an underlying asset. The credit payment is at the initial stage and then use two put options to form a range consisting of the high and low strike price.

A bull put spread consists of two put option first as the investor buys a put option and pay a premium. Investors will sell a second put option at a strike price higher than the one they purchase. The premium earned from selling higher strike exceeds as both options have the same expiration date. The bullish investors use a bull put spread to generate income with a limited downside. The reason to expire is that no one wants to exercise and sell their shares at the strike price if it is lower than the market price.

view moreWe use this strategy because the profit in trade is made from the premium paid. They are advised to adopt the strategy when good premiums are present. The attractive premiums can be seen when markets decline. We should ensure that there is more time in the expiration date as the market is looking to move into a bullish trend.

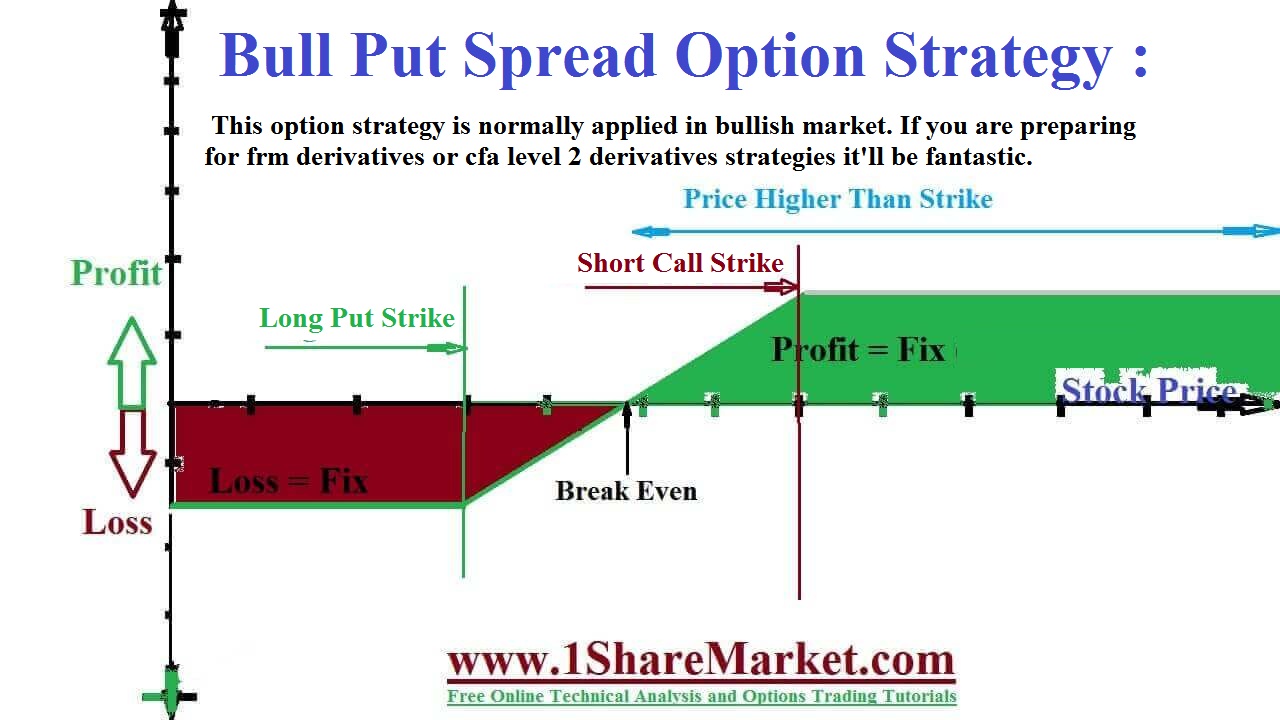

The potential profit is limited to the net premium that receives fewer commissions.

The potential loss is limited if the stock price falls below the strike price. Maximum loss is calculated by taking the two strike prices minus the premium received.

The Breakeven is equal to short put strike minus the premium received.

Consider a 70-75 bull put spread value at $2 consist a sell at 75 strike price put and buy a 70 strike price. The $2 premium would represent max win if the stock stays above the 75-strike price. They will have a $5 strike width representing the max loss. If the trading finish below both strike price minus the premium received to get into the trade.

The strategy limits the profit which is earned if the stock rises above the upper strike price of the sold option. If the stock is below the upper strike the investor will lose money because the put option will be exercised. The investor receives a net credit for strategy at the outset. They will provide some cushion for the losses as stock declines. So to wipe out the credit is received by the investor that begins loss of money in the trade.

It is the best strategy for traders who make a fast profit from a small increase in the price of a security. The profits and losses are limited as such it's an appropriate strategy. If you have a concern that security could fall in the price instead. Because of the high trading level, we advise beginners to consider other strategies. The investor believes that underlying stock will show an increase in price. The maximum gain is realized when the positions are imitated and face loss as maturity.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India