The Bull Call Spread Option Strategy is a simple strategy that a trader can implement. Spreads are the multi-leg strategies that involve two or more options. The leg strategy means the strategy which requires two or more option transactions. It is a strategy as bull call spread is best when your outlook on the stock is moderate and not aggressive. Among all the spread strategies these is one the popular option. This strategy comes when you have some bullish view on the stock. The Strategy is a two-leg spread strategy that involves ATM and OTM options. Here we can create the bull call spread using other strikes. It consists of one long call with a lower strike price and one short call with a high strike price. So both calls have the same underlying stock and same expiration date.

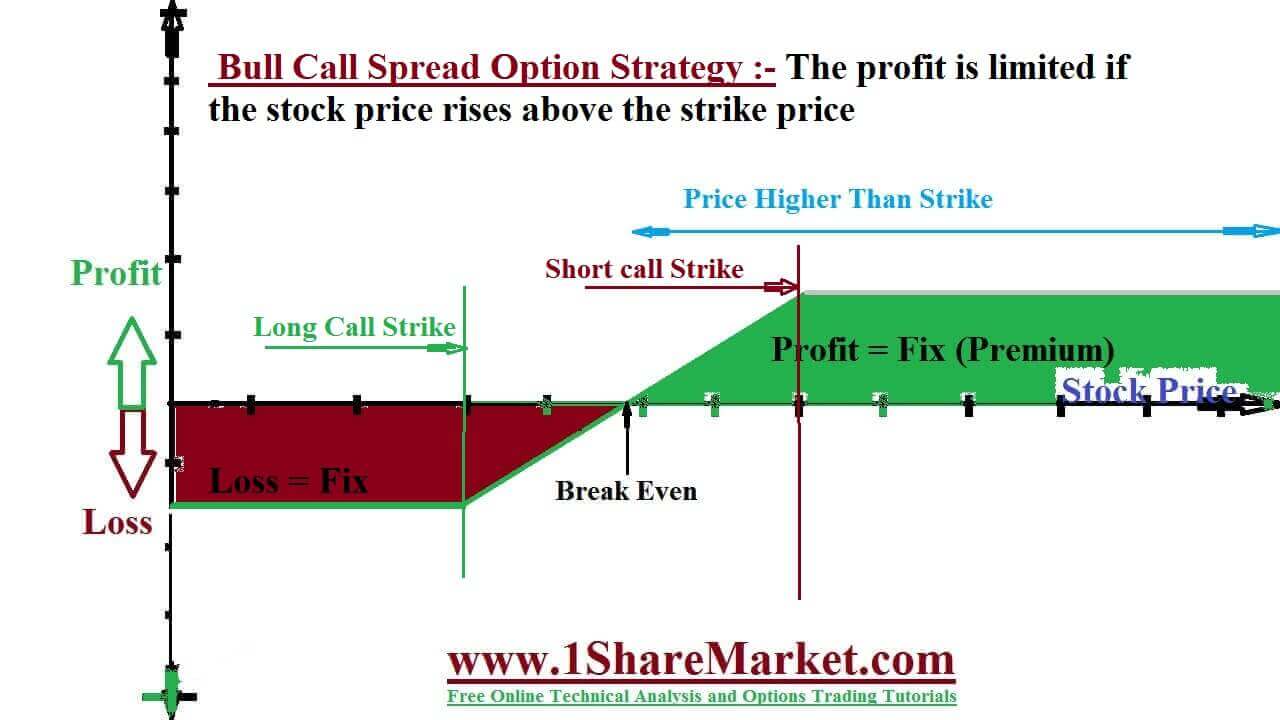

The bull call spread is established for a net debit and profit as underlying stock price rises. The profit is limited if the stock price rises above the strike price of the short call. Then potential loss is limited if the stock price falls below the strike price of the long call. The strategy is constructed by selling high strikes in money put options and buy the same number of lower strikeout of money put options the same expiration date. It hopes that the price of the underlying security that goes up far enough that is written put option expire worthlessly. These is common to use options trading strategy. It is simple, primarily used when the outlook is bullish and expectation is an asset that will increase a fair amount in price. It is considered an alternative to long calls because it involves the writing call to offset buying calls.

Profit : The max profit is calculated by the difference between the two strike prices minus the premium paid. When it reaches strike trade over the above strike price is at expiration.

Loss :It is the cost of trade and reaches when the stock trader is under lower strike price at expiration.

Breakeven:Breakeven Bull call spread=Lower strike price+cost of trade

view moreHere a 55-65 call spread costs $2.50 consisting of buying 55strikes price calls and selling at 65 strike price calls. The strategy has a $10 wide strike width which is more than an investor which could make on trade minus the premium paid to get into a trade. So $2.50 leaves the investor with a max profit of $7.50.

Here you should reduce the cost of entering a long call position because of entering a short call position. The potential profit is done by this that can control how much you stand to make by choosing the strike price of contracts to write. You have a chance to make a larger return on your investment than would be by simply buying a call and reduced loss if the underlying security falls in value. It appeals to traders and knows how much stand to lose a point of putting spread on.

There are more commissions to pay than if you were buying calls but benefits should be more than offset that minor downside. Here your profits are limited and if the price of the underlying security rises beyond the strike price of the short call option you can’t make a future gain.

This strategy is not executed often unless there is evidence of an expected upward movement. It requires less capital to participate than simply purchasing stock that means lower risk but is still considered to be a lower probability of successful trade. These is a simple strategy that offers a number of advantages with little disadvantages. It is a good strategy to use when your outlook is bullish and believe you can be accurate in predicting how to increase the price of the underlying security.The profit is limited if the price of underlying security rises than you expect. You can reduce your cost at the outset and improve the potential return on investment and limit the amount you can lose.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India