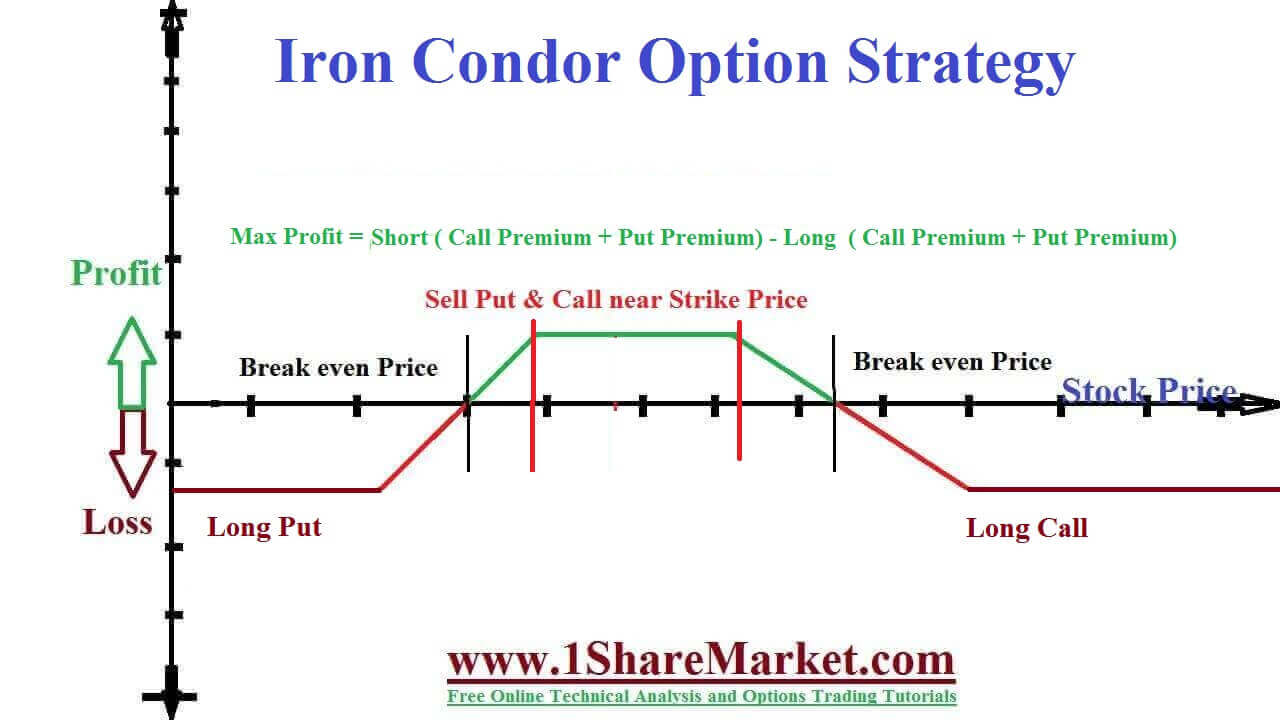

Iron Condor Option Strategy : There is a high probability of gain by using Iron Condor Option Strategy. The option trader resort to strategy if they believe that the market is going to be rangebound. They have a counter-view on the direction of security price. The call option buyer believes the price of the underlying security if goes high. The call option writer believes that the price of the underlying security is going falls. If the strike price is less than the current market price of the underlying security the option has intrinsic value. The iron condor is formed by four options of as two puts and two calls. They will also have four strike prices with the same expiration date. The goal of the strategy is to profit from low volatility in the underlying asset.

The iron condor earns a maximum profit when the underlying asset goes close between the middle strikes prices at expiration. They will have the same payoff as regular condor spread but use both calls put instead of calls/puts. The condor and iron condor are extensions of the butterfly spread and butterfly. The iron condor is neutral and profit when the underlying asset doesn't move. It has limited upside and downside risk because of the high and low strike option wing that protects in either direction.

The trader can take two positions by using an iron condor strategy. They use balanced selling and busing calls where put is involved. The trader covers both side options with long and short pull/calls. It covers every position of buying and selling the same number of the money call and put to another.

When to manageWe manage iron condor by adjusting the untested side of the spread. We roll the untested spread close to stock price to collect premiums.

Profit/LossThe trader will start to lose trade if the stock move outside the inner short strike price and penetrate the call spread upper side/lower side. The maximum loss is calculated by taking the difference between the call side and the put side minus the premium received.

view moreHere there are two breakeven points as upper breakeven is equal to the addition of short call strike and credit received. The lower breakeven is the subtraction of short put strike minus the credit received.

The iron condor is the best options strategy for investors who are predicting for a neutral market. The money of trader goes with better chances of success but the trader will receive a lower premiums. They allow investors to enter the positions with risk, high returns on capital, with a high probability of success. It uses two spreads and the goal of the long condor is to keep the trading range narrows. The short condor has the aim of high volatility to put one short option in the money.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India