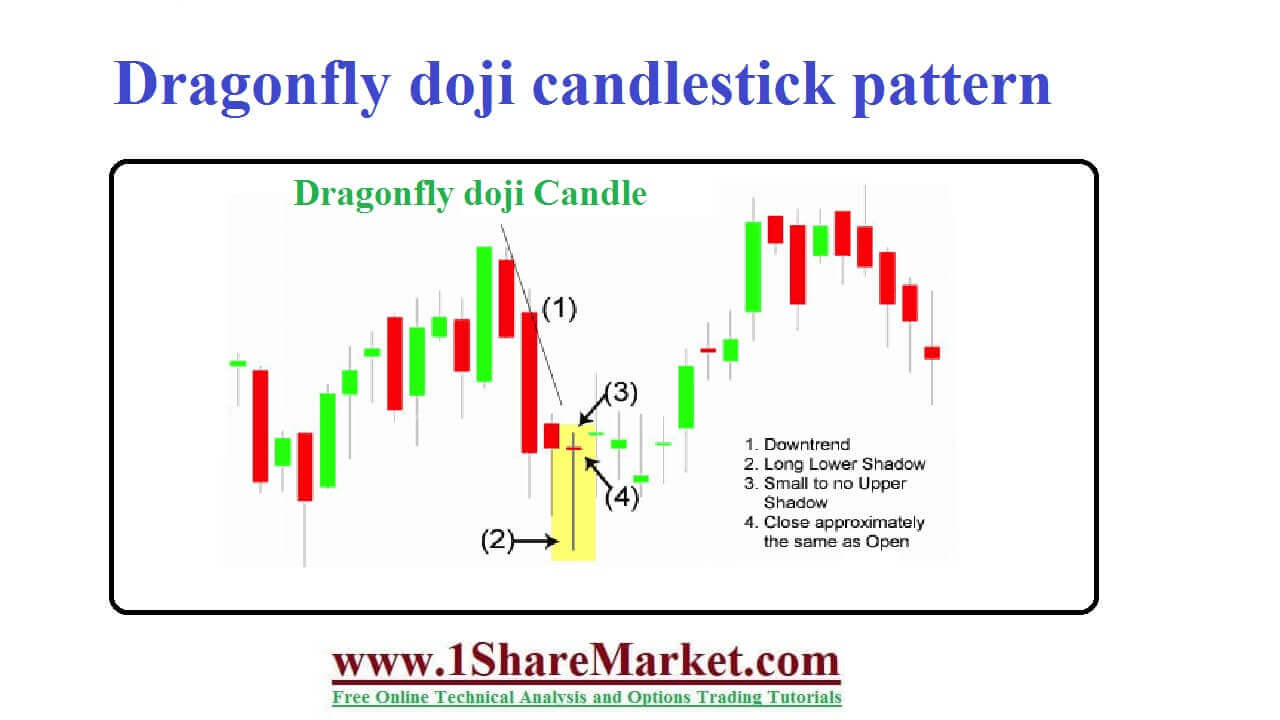

Dragonfly doji candlestick pattern : Dragonfly Doji candlestick will occur when the opening and closing price is at the same level but a long lower wick. It is the same as bullish Doji means when the market opens the sellers come in and push the price lower. It is not long before the buyers take control and fight their way back higher. It acts as an indication of investor indecision and a possible trend reversal. It will occur when the market trades down and reverses but does not move above the opening price. The dragonfly candle is considering a reliable indication of a trend reversal. It has no real body and a long downward shadow. Dragonfly candle will suggest an aggressive selling but strong buying force to bring the closing price up to the opening price. It appears during uptrend or downtrend with different meanings. It confirms the presence of sellers in the market but the downtrend gets invalidated by strong buying pulls. It is a candle reversal pattern that forms after a bullish or bearish trend.

Also called as a sign of strength as buying pressure that overcomes the selling pressure. You can trade both Dragonfly and Gravestone Doji in a range or trending markets. The Dragonfly candle works well when used in conjunction with other indicators and has high volume. Dragonfly candle is more reliable than a relatively low volume one. The confirmation candle has a strong price in strong volume. It appears in the context of a larger chart pattern.

view more

No assurance is given at the price that will continue in the expected direction of the confirmation candle. Traders will need to find other locations for stop-loss that may not justify the potential reward of the trade. The candlestick patterns, indicators are required to exit the trade when it is profitable.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India