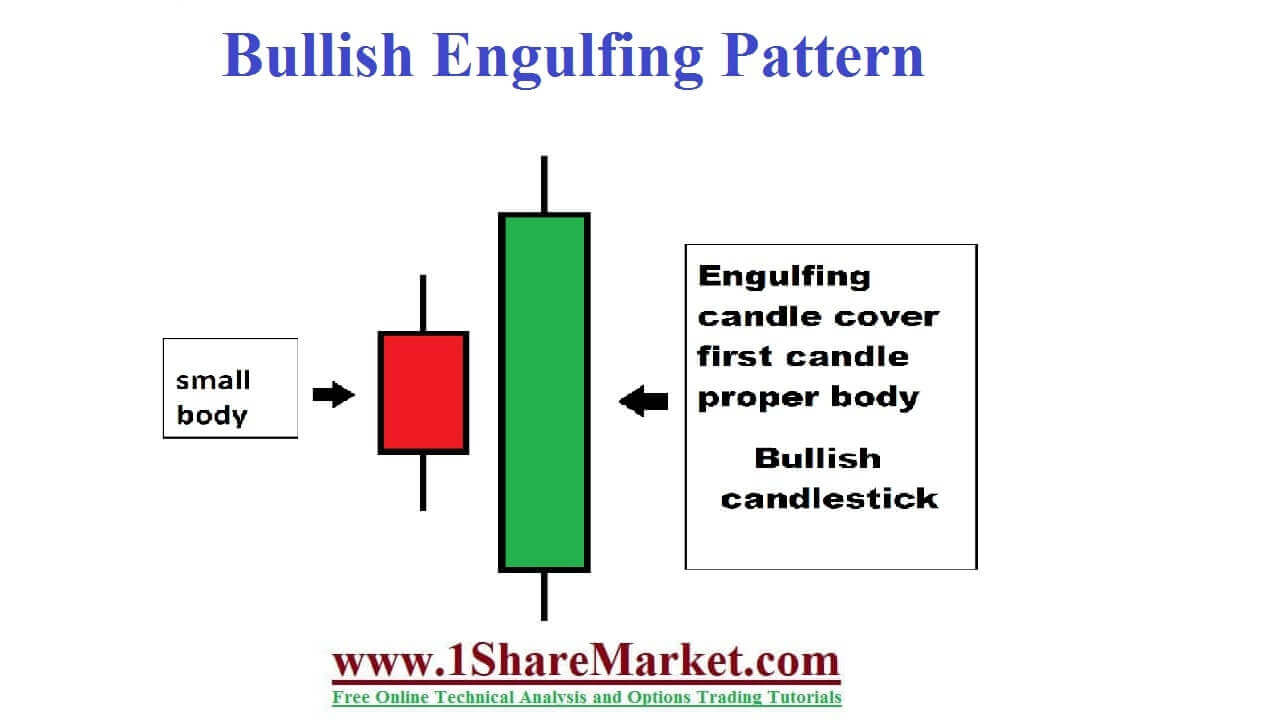

Bullish engulfing pattern : The bullish engulfing candlestick pattern signal to a reversal of a downtrend and indicate a rise in buying pressure when it appears at the bottom of a downtrend. The pattern will trigger a reversal of the ongoing trend as more buyers will enter the market and move the price further. The pattern involves two candles with the second green candle that is completely engulfing the ‘body’ of the previous red candle. When a bullish engulfing pattern is found at the bottom of the downtrend it signals uptrend reversal. Similar manner when a bearish engulfing pattern is found at the top of an uptrend it signals downtrend reversal. The pattern is also used as a signal to exit if a trader holds a buying/selling position in the ongoing trend coming to an end.

The prior trend is a downtrend. Then the second candlestick should be bullish and engulfing of the body of the first candlestick. Replace below the low where the bullish pattern occurs. Then confirm the signals given by this pattern with other technical indicators and use relative strength index

view more

These candlestick involves two candles with the latter candle ‘engulfing’ the entire body of the prior candle it can be bullish or bearish based on where it forms with the ongoing trend. The engulfing candle helps the traders in spotting the trend reversal that indicates trend continuation and assists traders with an exit signal. It is the type of multiple candlestick patterns that tend to signal a reversal of the ongoing trend in the market. This candlestick pattern involves two candles with the candle ‘engulfing’ the entire body of the prior candle.

The engulfing candlestick can be bullish or bearish based on where it forms in relation to the going trend. In a single candlestick pattern, the trader needs one candlestick to identify a trading opportunity. At the time of analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. These is the multiple candlestick patterns that we require. The engulfing pattern needs two trading sessions to evolve. Here we will find a small candle on day 1 and a long candle on day 2 which appears to engulf the candle on day 1. If the pattern appears at the bottom of the trend, it is called “Bullish Engulfing” and if it appears at the top end of the trend it is called the “Bearish Engulfing” pattern.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock

market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not

SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize

institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune,

India