Morning star candlestick pattern originates from Japanese rice merchants. The identification is done by star if the small body of the candle is positioned above the price range of the previous candle. It is one of the BCG growth-share matrices that represent the division within a company and has a large market share in an expanding industry. Here candlestick is also called a price chart used in technical analysis to display close, open, high, and low security for some time. Then the traders use it to track market prices, daily momentum. The large part of the candlestick is called the real body and tells an investor to close the price which was higher or lower than the opening price. The shape gets varied because it is based on the relationship between the low, opening, and closing price of that day.

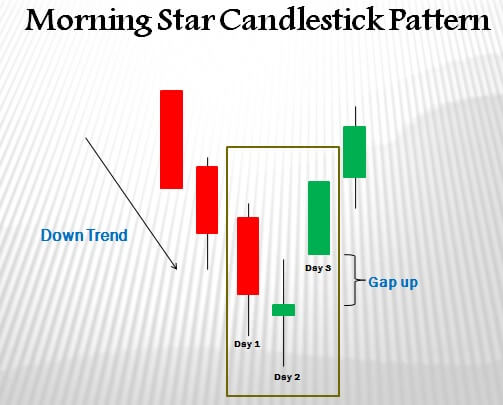

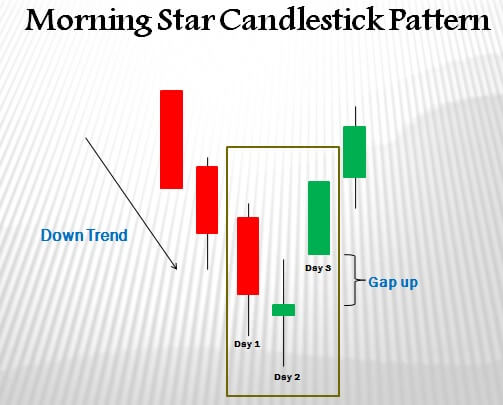

Candlestick reflects the impact of investors on security prices that are used by analysts that determine the time of entry and exit the trade. Candlestick charting depends on the technique that is developed in Japan for tracking the price of rice. Morning Star pattern is the formation of a three candle bullish reversal that appears at the bottom of a downtrend. These is formed at a downward trend and the signal will begin from first in the upward movement of price. The signal is of a reversal price trend the traders analyze the formation and seek confirmation that reversal confirms using indicators.

Identify on the forex chart involves the identification of three main candles. The market should be exhibiting high and lower. The bearish candle results in large selling pressure and continues toward the downtrend. The traders should look for short trades with no evidence of a reversal. Then the second candle is a small candle as the Doji candle presents the first sign of a fatigued downtrend. The real sign of buying pressure is revealed in this candle. In the non-forex market, the candle goes up from the close of the previous candle and signals at the start of a new uptrend.

view more

EUR chart consists of a morning chart as there is an established downtrend leading up to the formation of the reversal pattern. Once the formation has complete the traders look to enter at open of the next candle. Traders could delay their entry and wait to see if the price moves higher. The drawback is that traders could enter at a much worse level as in fast-moving markets. The morning star is a bullish candlestick pattern and evolves over a three day period. It is a downtrend reversal pattern formed by combining 3 consecutive candlesticks. These is a visual pattern as there are no particular calculations to perform. There is a technical indicator that helps to predict if a morning star is forming.

These candlestick will occur frequently in the forex market. The pattern will have a well-defined entry and stop level.

Trading is a visual pattern that can be a risky proposition. The morning star is best when it is backed up by volume and indicator like a support level and easy to see morning stars forming a small candle pops up in a downtrend.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India