Short Strangle Option Strategy : A short strangle invented for a net credit and profit underlying stock trade in a narrow range between the breakeven points. The profit potential is limited to the total premium received in little commission. They have slight modifications in the short straddle that improves the profitability of the trade. They have greater movement in the underlying stock. The short strangle strategy is profitable and used in an incorrect manner. Here first is an out-of-the-money put and the second is an out-of-the-money call. The underlying stock moves for the call and is put to exercise. They have advantages of stock volatility and used when low volatility is expected for the underlying stock. The credit is received by short strangle and reaches a maximum profit when stock stays within the range of two strike prices. The profit opportunity is limited to the total premiums received. They work best when the stock has little movement until the expiration. The investor receives maximum win if the stock finishes within the strike prices at expiration.

The short straddle has one advantage and three disadvantages. The advantage is that the premium received and maximum profit potential of one straddle is greater than for one strangle. The disadvantage is here the breakeven points are closer together for a straddle than for a comparable strangle. There is a small chance that will make maximum profit potential if it is held to expiration. They are less sensitive to time decay than strangles. So when there is little or no stock price movement, short straddles will experience a lower percentage profit over a given time period than a short strangle.

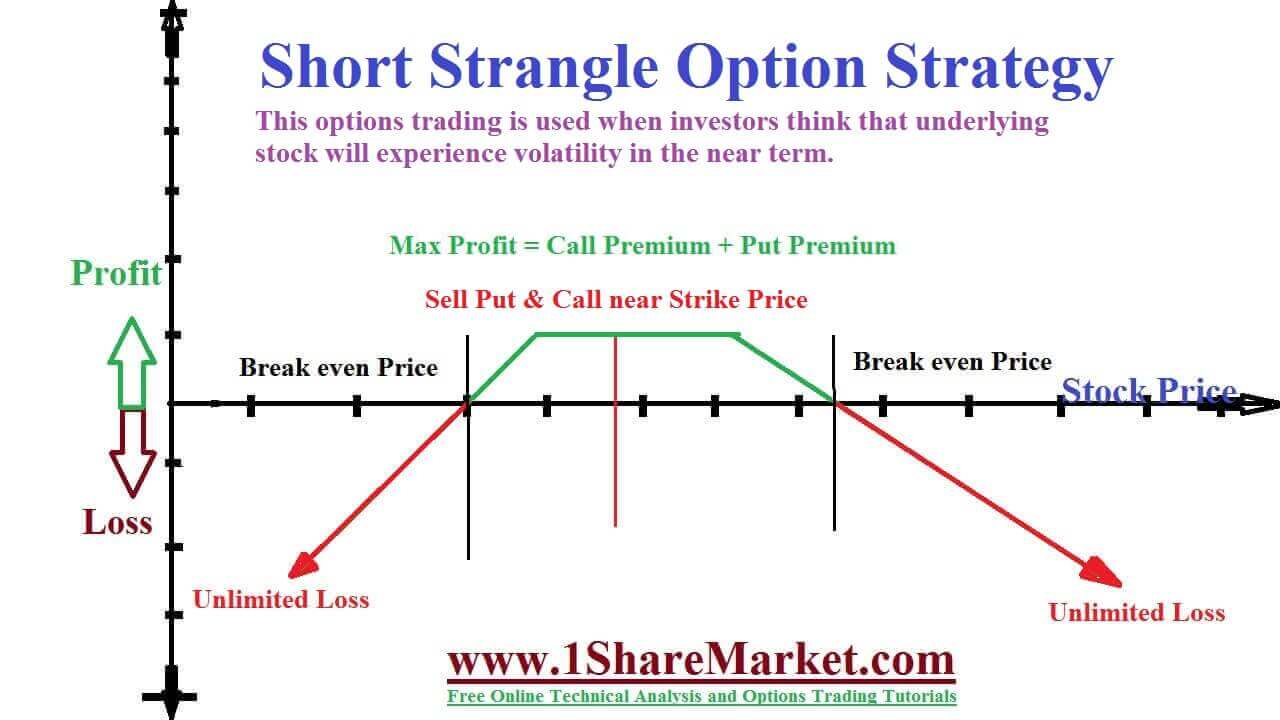

view moreThis options trading is used when investors think that underlying stock will experience volatility in the near term.

The maximum loss is unlimited as a stock that continues to move against the trader in either direction. The profit achieved when the price of the underlying is in between the strike price of the short call and the strike price of the shot put.

The Maximum Loss is unlimited here. The loss occur when the price of underlying greater than the strike price of short call plus net premium received

The breakeven on the upside is calculated by adding a premium of call strike price and downside subtracting premium from the put strike price.

If a trader executes a short strangle at price sell of 1 ABC 105 call at 2.20 and sell 1 ABC 95 put at 2.30. The net credit will be 5.50. At the time when stock is between 95 to 105 then traders keep the full at $5.50 and achieve maximum gain. When stock comes up to $112 trader losses from $7 to105.The strike price is received at $5.50 as they have a net loss of $1.50.

This market is neutral which makes more sense when there is no announcement or earning scheduled. The trader will like to sell strangle that receives two premiums of the stock. The time decay is working for investors as they look for both options to expire worthless as time goes on in this position. The trade has unlimited risk to select while executing a trade and keep quantity sizing small.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India