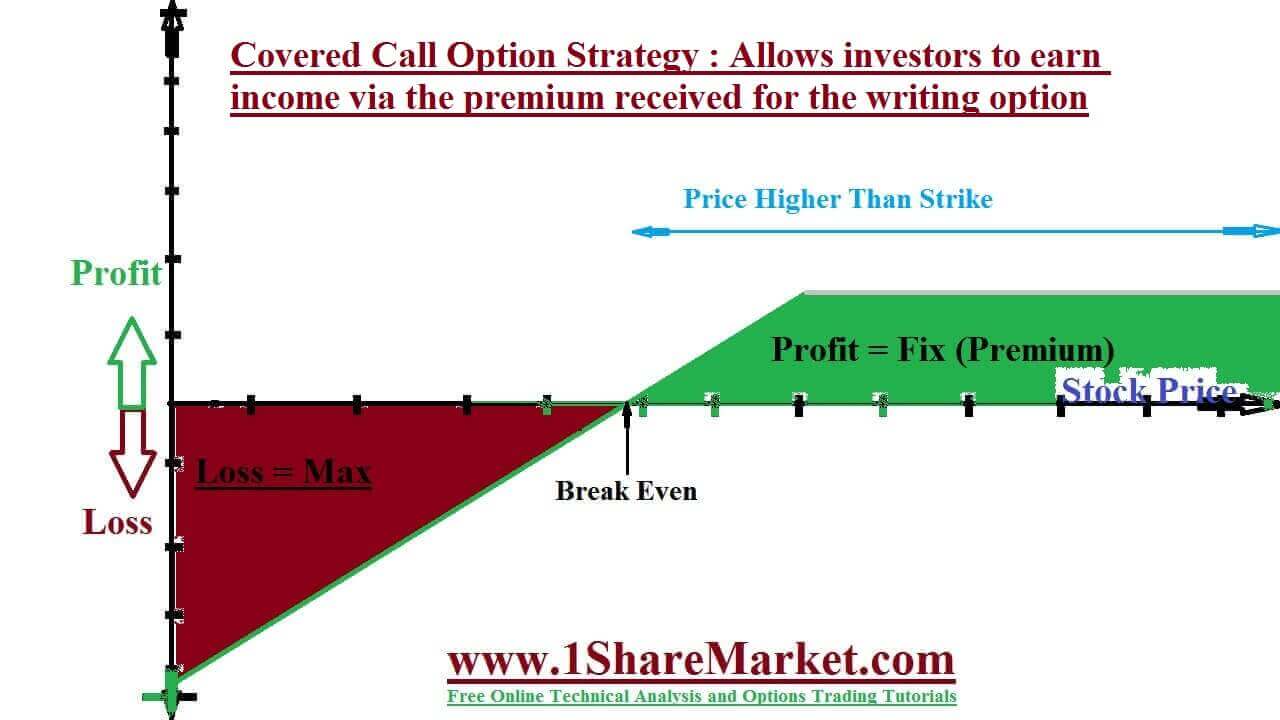

The Covered Call Option Strategy are a neutral strategy means the investor only expects a minor increase or decrease in the underlying stock price for the life of the written call option. The covered call serves as a short-term hedge on a long stock position and allows investors to earn income via the premium received for the writing option. The investor forfeits stock gain if the price moves above the option strike price. They are obligated to provide 100 shares at the strike price if the buyer chooses to exercise the option. A covered call strategy is not useful for a very bullish or a bearish investor. If the investor is bullish they are better for not writing the option and holding the stock.

The option cap has the profit on the stock which could reduce the profit of the trade if the stock price spike. If an investor is bearish they may be better off selling the stock since the premium received for writing a call option will do little to offset the loss on the stock if the stock plummets. A covered call is selling your right to another which is an interested party for cash paid today. The contract is struck between you and the buyer of the option that you are given by him. He has the right to purchase your stock at a foreordain price and before a predetermined date.

The covered call is usually opened within 30 to 60 days before expiration. It allows a trader to benefit from time decay. The optimum time for implementing the strategy depends on the investor's goals. So the goal is to sell calls and make money on the stock. It is best if there is not a lot of difference between the stock price and the strike price. If the goal is to sell the stock and call then you should be in a position where the calls will be assigned.

view moreHere you receive money on the same day you sell the call option. The call option is used to gain short term profit. As if you purchase a set of stocks today for USD 50 and believe that they will rise to USD 60 in six months but after some short-term profit. You may sell a call option for the stocks at USD 55. So by selling these you gain profit seven you get less for them than if they were at USD 60 after six months.

The selling covered call option can be useful and beneficial for you. It will reduce the risk and increase your profit. But it can also reduce your profit by trading the money you get from free right away and collecting the options for higher gain. The covered call is a double-edged sword that needs to be approached with caution.

Formula is,

Max Profit=Strike Price-Current Stock+Premium received for selling the call options contract Or Max Profit Achieved When Price of Underlying >= Strike Price of Short Call

The potential loss can be large and occur when the price of the underlying security falls. This risk is not different from which the typical stock owner is exposed. The formula for calculating loss is,

Maximum Loss = Unlimited

The loss occurs when price of the underlying is less than the purchase price of the underlying - premium received

Here the loss is equal to purchase the price of underlying -the price of underlying - max profit + commissions paid.

Break even is the difference between current stock price and premium received for selling call option. The underlying price at which break-even is achieved for covered call position is calculated using the formula as the Break even Point is equal to the Purchase Price of underlying minus the Premium Received.

The option trader purchases 100 shares of ABC stock trading at $50 in June and writes a JUL 55 out-of-the-money call for $2. He pays $5000 for100 shares of ABC and receives $200 for writing a call option that gives a total investment of $4800.So on expiration, it is rallied to $57. The $55 is a striking price for the call option that is lower than the current trading price. Writer sells the shares at $500 profit when call is assigned. The total profit goes to $700 after factoring in the $200 premium is received for writing the call.

They will carry risk and benefit in granting a short-term benefit and also decrease potential loss. If you want to execute, it will be worth it then you will have to study your chance and make a decision based on objective data and accurate statistics. It is a way to generate an income from owning stock and suitable for investors with all skill levels. They are financial market transactions in which the seller of the call option owns the amount of the underlying instrument as a share of stock. So if the trader buys the underlying instrument at the same time the trader sells the call called a buy-write strategy.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India