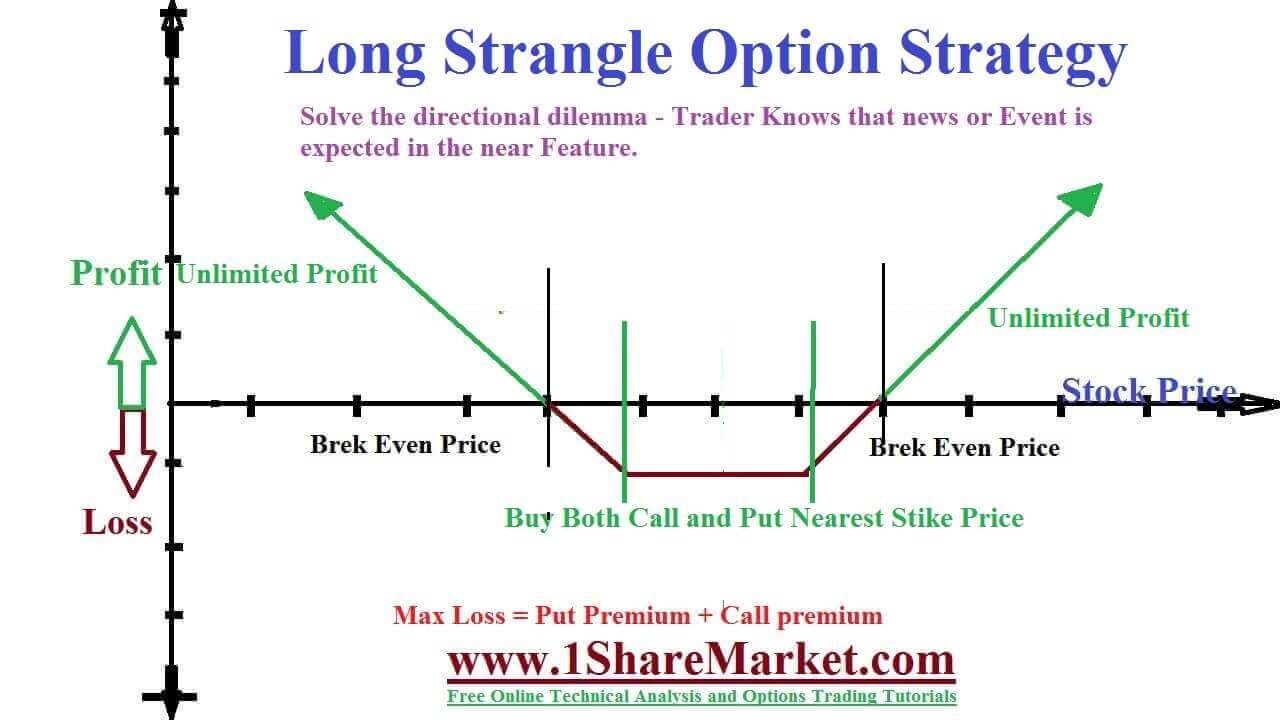

In Long Strangle Option Strategy traders will take options in both directions of potential price movement. It is a neutral strategy that has OTM Put option and OTM Call together with the same underlying asset and expiry date. They have limited risk and unlimited reward strategy.

The Long Strangle Option Strategy is used for some scenarios where you can see a lot of volatility in the market due to election results, annual result announcements. The long strangle is classified as volatile options because it is used to make a profit out of substantial price movements in those movements. They are used if you have confidence that the price of a security will move significantly in one direction or another. Purchasing long calls is primarily a directional strategy. The strategy may prove benefits when the investor feels large price movement in an up or down direction This strategy has limited risk, easy to understand, and requires a low trading level with a broker that makes it ideal for traders as well as veterans.

view moreThe strangle is simple options spread that requires placing two orders with your broker. We need to buy calls on security and buy the same amount of puts on the same security. The transactions are made at the same time and use option contracts that are out of the money. Keep the cost low by buying contracts that are close to expiration, but allow less time for the price of the underlying security to move. So buying contracts with more time until expiration will be more expensive, but give a greater chance of making a profit.

The long strangle returns an unlimited profit if the price of the underlying security makes a sizable move in either direction. At the time of a big move, one of the legs will return a substantial profit while the other leg will cost only the amount spent on the options. If the underlying security has no movement in price or moves very little then it will return a loss. The maximum profit is unlimited as the position continues to pick up again and further stock travels in either direction.

Maximum loss=Net premium paid

A strangle has two breakeven points as lower and upper.

Lower breakeven=Strike price of Out –Net premium

Upper breakeven=Strike price of call+Net premium

The trading time with $50 and stock increase or decrease in the future. The investor can purchase a $55 call and $45 put for the net cost premium of $4.If the stock increases to $65 upon expiration, then a $55 call would be worth $10, less than a $4 premium. This results in a profit of $6.If the stock drops to $35 upon expiration then it has $45 put similar be worth $10 results in the same $6 after deducting the premium paid. If the stock is between the two strike prices of 45 and 55 then traders will lose their $4 investment.

The long strangle is a simple strategy that represents the best way to try and profit from significant price movement in either direction. There are only two transactions involved in a commission that are low and the relevant calculations straightforward. This is easily used by beginner traders. The long strangle has a long call and a long put so time decay works against the buyer of this strategy.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India