Using Short Put Option Strategy you are obliged to buy the underlying security at fixed price in future. So it is a low a profit potential stock trade above the strike price and exposed to high risk if stock goes down. It is helpful when you expect volatility to fall that it will decrease the price of the option you sold. A short put is best to use when you expect the underlying asset to rise. It has benefits that remain at the same level because the time decay factor will be in your favor as the time value of put will reduce over a period of time. It is a good option trading strategy to use because it gives you upfront credit which helps to offset the margin.

The short put option helps in generating regular income in a rising market but doesn’t carry risk that is not suitable for a beginner trader. The strategy to use if you expect the underlying asset to rise in a short period of time is to try a long call trade strategy. It is another way to describe the strategy of selling put options. The short put is simple in some respect as it involves one transaction is an ideal strategy. It requires a high trading level and you are exposed to a lot of potential risk.

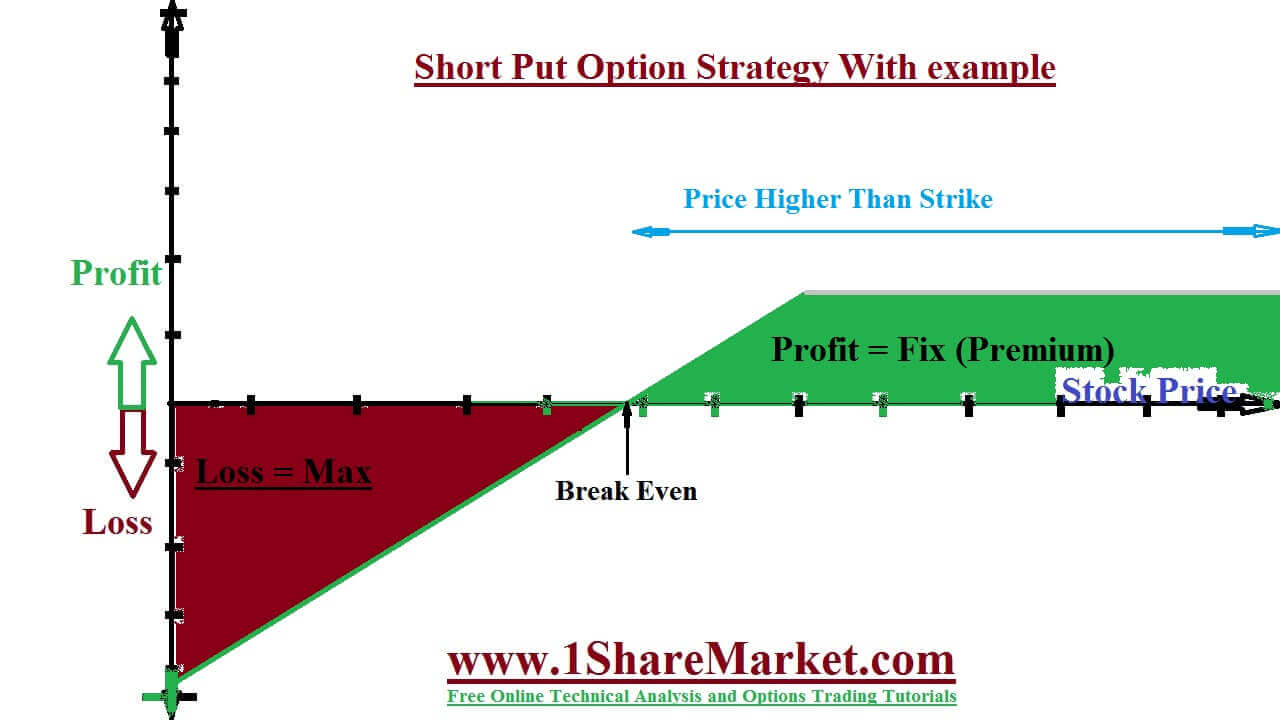

It is a bullish option trading strategy so we use it when we expect a security to go up in value. So to make a fixed amount of profit this strategy is best to use when you are expecting a security to go up in value by a small amount. The strategy offers you a real protection against the underlying security falling in value, so you should use it if you are confident that security will not decrease in price. This is a very straightforward trade as you place a sell to open order with your broker to write puts based on the underlying security to increase in price. If you want to increase your potential profit write in an expensive manner with a higher strike price but you need the security to increase the price for the contract to expire out of money. You could write the money puts so that you could profit if the price dropped but these would be cheap and you can make less profit. The Max Loss is unlimited in a falling market that is limited to the total value of the stock position as a stock cannot trade below zero. Max Gain is limited to premium received for the selling at put option.

view moreThe short selling and buying put options are bearish strategies that become more profitable as the market drops. It involves the sale of a security that is not owned by the seller but borrowed and then sold in the market. So to buy it back with potential for large losses if the market moves up. Buying a put option gives the buyer the right to sell the underlying asset at a price stated in the option with the maximum loss to premium paid for the option. The short sale and put option have risk reward profiles that may make them suitable for novice investors.

The investor is bullish on stock XYZ which is trading which is trading at $30 per share. The investor will believe the stock that will steadily rise to $40 over next several months. Traders could buy shares but this requires $3,000 in capital to buy 100 shares. The investor wrote a one put option with a strike price of $32.50 that expires in three month for $5.50. The maximum gain is limited to $550 to maximum loss is $2,700 to x 100 share.

Maximum profit is limited as per option written to “Price of Option”

Price of Underlying Security >=Strike Price

It is limited only by how much the underlying security can fall.

The loss is incurred Price of Underlying Security < (Strike Price – Price per Option)

Loss per option is strike Price-(Price of underlying Security+ Price per option)

The Break-even point Price of Underlying Security = (Strike Price - Price of Option

This is a simple strategy but does carry risk and is far from ideal for beginner traders. It is best to make a quick profit from a security that you expect to increase a small amount in price within a short period of time. It is a good strategy to use if you are expecting a big increase in the price of the security or if you think there is any chance that security will drop in price.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India