The Bear Put Spread Option Strategy requires investors to buy in the money put option and sell an out-of-money put option on the same expiration date. It creates a net debit to bring down the cost and raise the breakeven on buying a Put. They need a bearish outlook and the investor will make money when the stock price falls. The Puts sold will reduce investor cost, risk, and then raise the breakeven point. If the stock price closes below out of the money put option then investors reach maximum profit. The stock price increases above the money put option strike price at the expiration date as the investor has a maximum loss potential of net debit.

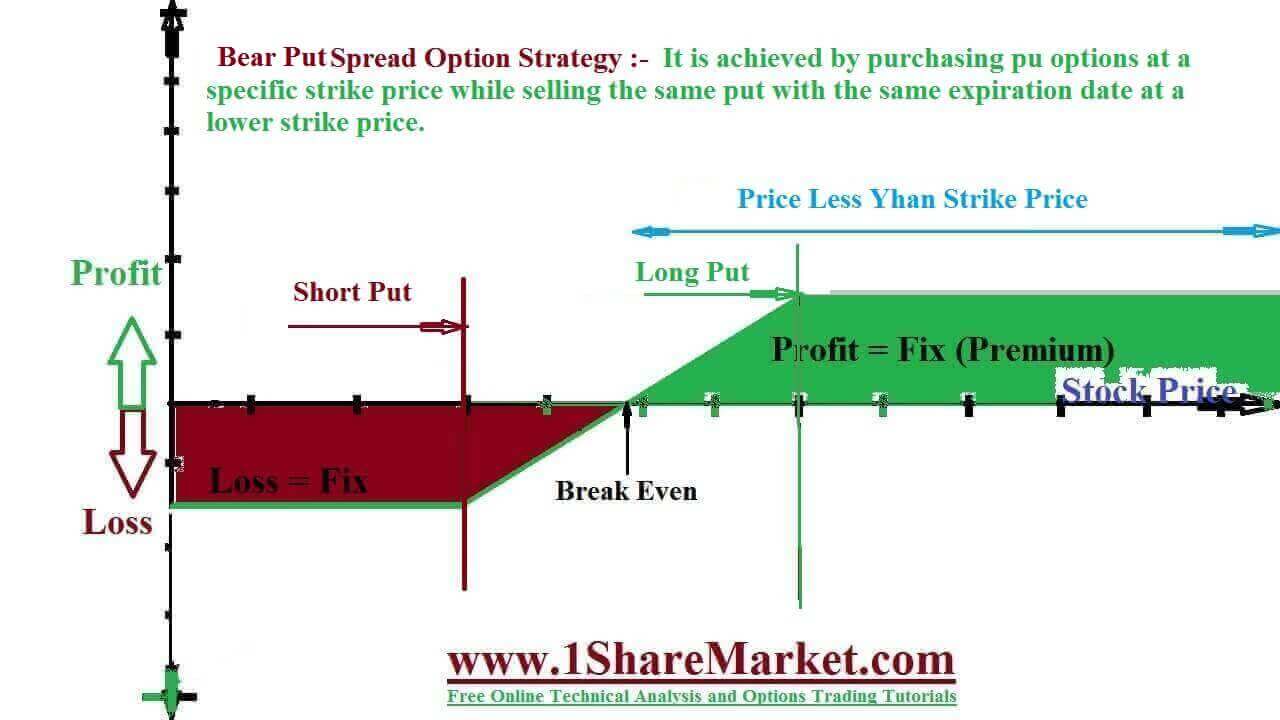

A bear put spread is a type of vertical spread consisting of buying one put in hopes of profiting from a decline in the underlying stock and then writing puts with the same expiration with a lower strike price. The bear put spread is an options strategy where an investor expects a moderate decline in the price of a security. It is achieved by purchasing an option while selling the same number of puts on the same asset with an expiration date at a lower strike price. The Bear Put strategy involves selling a Put Option while buying a Put option. This strategy is called the bear put debit spread as a net debit is taken upon entering the trade.

Why use We can start trading after the inverted hammer is identified to reap the benefits of security due to the bullish reversal. It is easy to identify the criteria associated with its recognition as proportionality between shadow and real body length.

When to UseThe period of the identification may lead to an upward reversal because there is no guarantee that this will last for an extended period. If buyers are unable to sustain in the market the security price may head towards another downward trend. These patterns are one of a number of candlestick patterns among a wide variety of metrics that are used to forecast market behavior.

ProfitMaximum profit=two strike prices -premium paid. Max Profit is achieved when Price of Underlying is less than equal to Strike Price of Short Put.

LossMax Loss is equal to Net Premium Paid plus Commissions PaidThe Max Loss Occur when Price of Underlying is greater than equal to Strike Price of Long Put

BreakevenBreakeven is equal to the long put strike minus debit paid.

view moreThe 40-50 bear put spread is costing $2.50 consisting of buying a 50-strike price call and selling 40 strike price calls. They have a $10 wide strike width which is most the investor could make on the trade minus the premium paid to get into the trade. The $2.50 leaves the investor with a max profit of $7.50.

The strategy is reducing the cost on a long put position through a short put position. It will not affect the limit of potential profits, but you can influence how much you can make from the spread by selecting the strike of the written contracts. The spread reduces the upfront costs means you can make a big return on your investment with the benefit of decreasing the amount you can lose. You know how much you lose at the point of putting the spread that helps with planning trades.

There are two transactions as of one you will pay more in commission, but overall reduced upfront cost compensates for this. Your profit is limited if the underlying security falls further than expected negative, but you use this strategy when you are expecting a security to drop in price by a certain amount.

This strategy should execute unless there is evidence of an expected downward movement. So a lower probability of success trade that relies on the stock to trade lowers before the expiration date. They require less capital to participate simply purchasing stock as lower risk called a probability of successful trade. The bear put spread option is employed when the options trader thinks that the price of the underlying asset will go down in the near term. It is implemented by buying a higher striking in a money put option and selling a lower striking out of money put option of the same underlying security with the same expiration date. It is the best strategy to employ if you have a bearish outlook and are confident to know how far the price of the underlying security will fall.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India