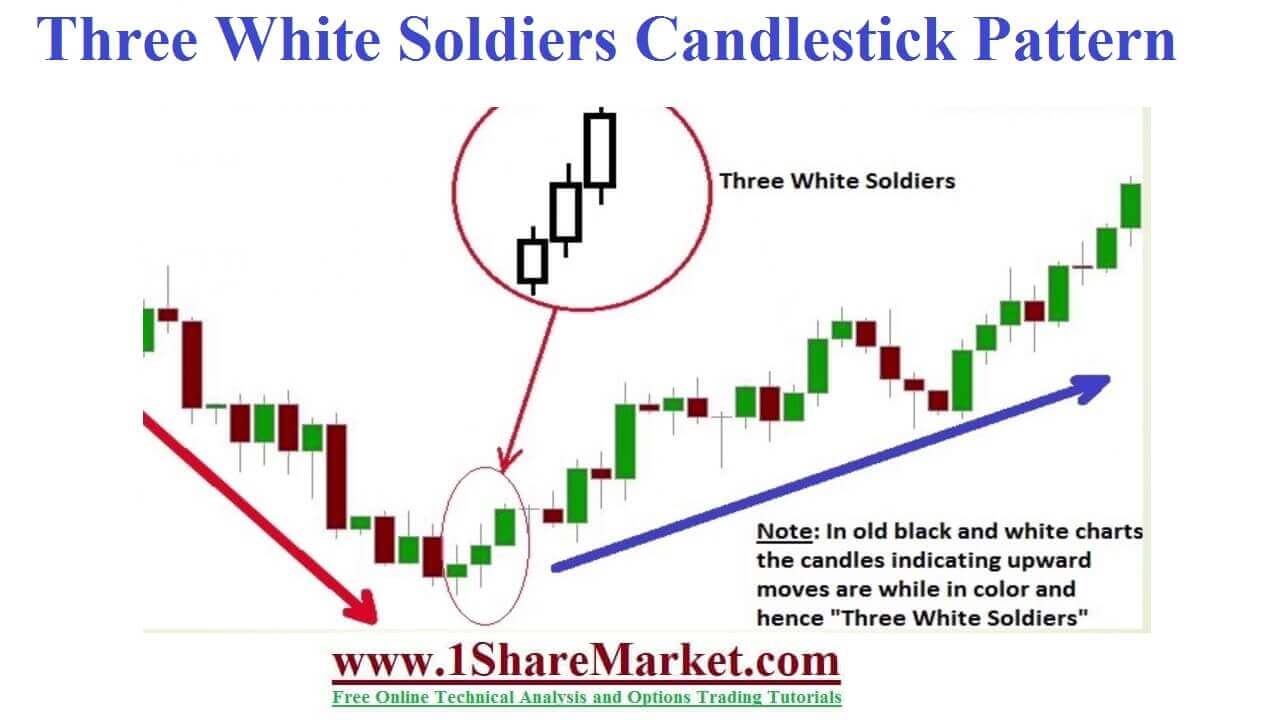

The Three white soldiers candlestick pattern used to predict the reversal of the current downtrend in the chart. Thes consist of three long body candlesticks that open within the previous candle body and a closing exceeds the previous candle's high. These candlesticks should not have shadow and open within the real body of the preceding candle. It is a steady advance of buying pressure that follows a downtrend. It will unfold three trading sessions and represent a strong price reversal from a bear market to a bull market. The pattern consists of three long candlesticks those trends upward like a staircase. The candlestick pattern is totally opposite of three black shares which share the same attributes in reverse order. The candlestick pattern is formed after a long downtrend when the bullish force is more than the bearish force for three consecutive days. These are created by three candles that will indicate a trend reversal. It is a candlestick formation used by technical traders to identify an entry in the market.

The Japanese candlestick is a unique formation in daily trading charts that will give traders an idea of price by capturing opening and closing prices. New traders interpret candlestick charts can be difficult so they should learn different formations to identify them in daily trading charts. Three long-bodied candles will denote upward movement and each opening within the body of the preceding one higher opening and closing. If a candle is formed without shadow it means bullish trend remained dominated and the price closed at the higher range. candlestick patterns appear after a Doji.

First candle that has a candle in a downtrend and white body. Then comes a second candle which has a white body then opening price within the previous body. Then the closing price is above closing price. Then the third candle includes a white body then opening the price within the previous body. Then the closing price is above the previous closing price.

view moreThree white candles are not sufficient to indicate the market change. It is considered in an upward trend reversal pattern because of three consecutive rising candles. Candles with long bodies will indicate a robust upward pull which occurs due to traders engage in overbuying, pushing the market hard. The pattern consists of three candles. Three white soldiers can also appear during periods of consolidation which is an easy way to get trapped in a continuation of the existing trend.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India