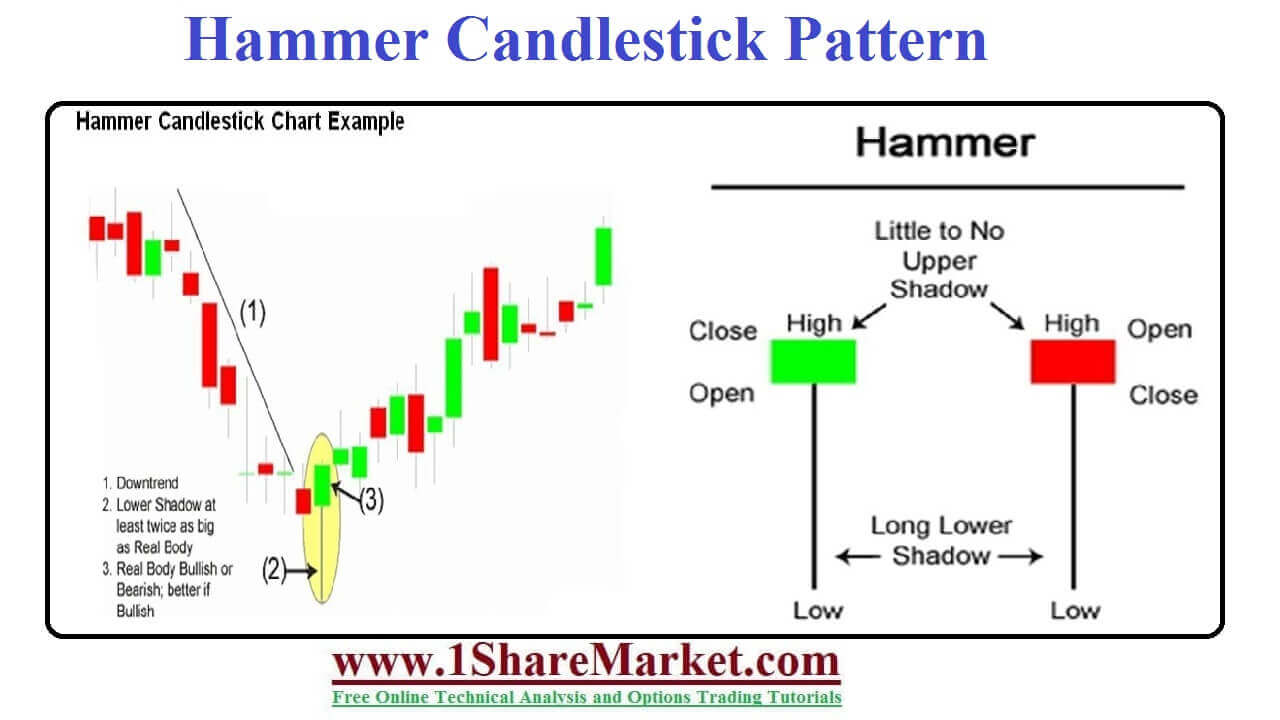

Hammer candlestick pattern will lower the shadow at least twice the size of the real body. The body of the candlestick will represent the difference between the open and closing prices. A hammer is a candlestick pattern that indicates a price decline is potentially over and an upward price move is forthcoming. The pattern is composed of a small real body and a long lower shadow. The shadow shows high and low prices for a period. The pattern is also called the bottom of the downtrend and signals a potential reversal in the market. A candlestick pattern is a one-line pattern that appears as a long line downtrend.

Hammer : It is a price pattern in the candlestick chart that occurs when security trade lower than opening but rallies within the period to close the opening price. Hammer occurs when the prices are declined. Hammers are effective when they have preceded at least three or more declining candles. A declining candle closes lower than the close of the candle before it. A hammer must look the same as "T" which indicates the potential for a hammer candle. Hammers will occur at all the time frames which include one-minute, weekly, daily charts.

Inverted Hammer :The inverted hammer candlestick is the same as a bullish hammer that provides a signal for a bullish reversal. The candle is called an inverted hammer when it has a long upper wick and a small real body with a little lower wick. To provide the bullish signal price will return above the open and return downwards towards the opening level.

view more

1) Reversal signal : The pattern will indicate rejection of lower prices. When found in a downtrend it signals the end of selling pressure and begins to trade sideways or upside.

2) Exit signal: - Traders have a short position that can view hammer candles as indicating that selling pressure is presenting the ideal time to close out of the short position.

1) In the isolation stage, the hammer candle will not take any trade as it will provide a false signal.

2) Here bullish reversal pattern of candlestick occurs at the bottom of the downtrend.

3) At open, high, and low the prices are the same and candlestick is formed.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India