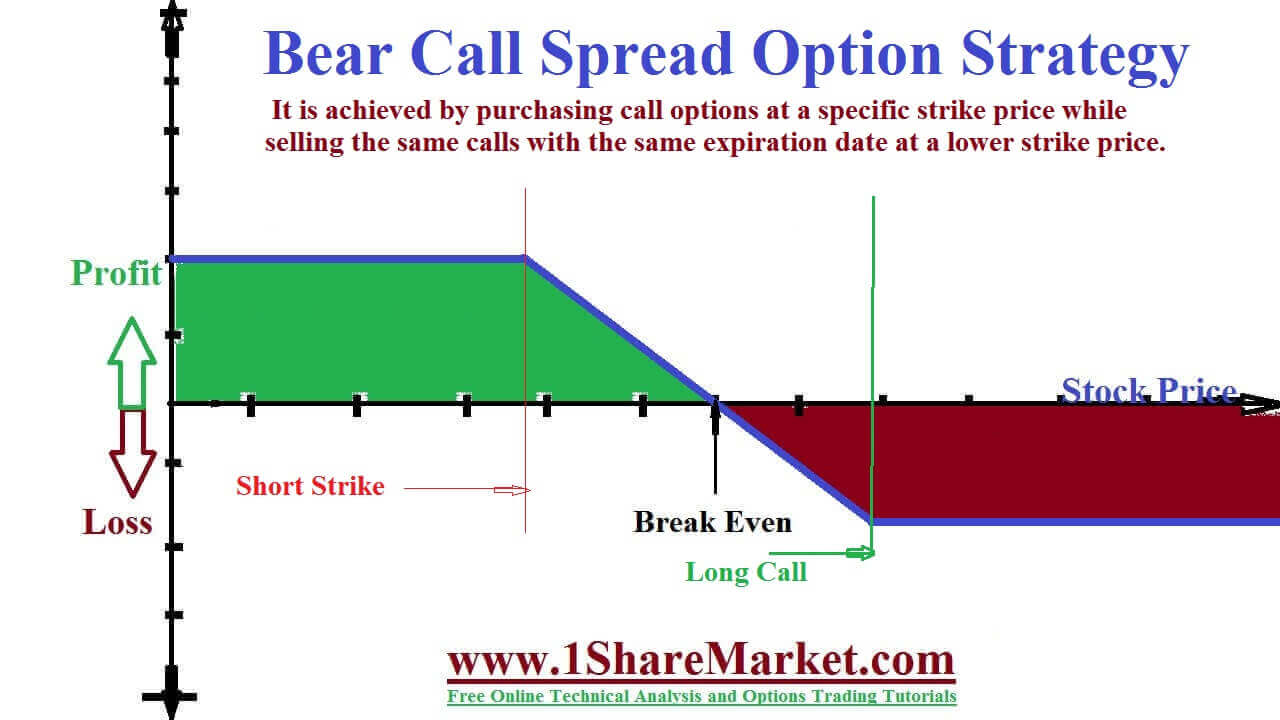

Bear Call Spread Option Strategy : The profit is gained using strategy which equals the credit received while initiating the trade. The limit of profits and losses are determined by strike prices of the call options. The strategy is a two-leg spread strategy that involves an ITM and OTM Call option that create spread using other strikes. It is used when an options trader expects a decline in the price of an underlying asset. This is used when an option trader expects a decline in the price of the underlying asset. It is achieved by purchasing call options at a specific strike price while selling the same calls with the same expiration date at a lower strike price.

To implement the bear call spread we have to place two orders with your broker. The order you need to place is the sell to open order to write a call based on the security. You have to decide which strikes are used for both sets of options. Then write a call that is at the money and buy one that is out of money. We get profit if the underlying security drops in price or if it stays the same. You write the money option but need a bigger drop in price to return a profit.

view moreThe stock is trading at $30 and the trader uses a bear call by purchasing one call option contract with a strike price of $35.The cost is $50 and selling with a strike price of $30 for $2.50.The investor will earn a credit of $200 to set up a strategy. If the price of underlying asset closes below $30 the investor will realize a profit of $200 (($250 - $50) - ($35 - $30 * 100 shares/contract)).

If the trader expects a decline than a big plunge in the performance of a stock a bear call spread strategy is best. Because the potential gain from a minimal decline is less and restricted to option premium. The long and short leg of these tends to offset the shock value of volatility. This strategy pays better when the market is volatile. Selling a call option is an obligation from the seller to deliver security at its pre-decided strike price. There is a huge potential loss if the security market prices soar to double or triple before the call option expires.

The loss occurs when the stock or index trade is at the strike price of the long. Max Loss is equal to the difference between the short and long call strike price minus the Net Premium Received plus Commissions Paid. The gain will occur when the stock or index trade is at the strike price of the long or below it.

The max gain is equal to the net premium received minus commission paid.

The Break-even is equal to the Short call Strike Price plus Net Premium Received. At underlie price, the break-even is achieved for the bear call spread position calculated.

Breakeven Point=Strike Price of Short call+Net Premium Received

It employs the principle of time decay which is a decline in the value of an option across time. The principle is to incorporate in options strategy if most options are not used. The bear spread will choose the option as a difference between the strike prices of the short leg call and the long leg call. This spread can be tailored to fit risk appetite.

The returns on a bear call spread can be limited and offset by moderate to high risk. If the short call leg is underlying stock that rises rapidly there is a risk of assignment. Here we can make a profit if the underlying security does not move at price and make the strategy a good choice in lack of confidence.

When the investors feel a stock moving lower and not on time then give them a cushion and use this strategy. Many traders flock to the bear call spread due to a high probability of success and limited risk. Because as the stock moves against a trader it can cost more than their initial investment.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India