Long put option Strategy used When investors speculate the market price of an underlying asset will drop they buy a long put to leverage their exposure to the price decline. In a long put, the option holders can sell the put before maturity to realize a gain or hold it to maturity. They must buy the underlying asset at the market price and sell it at the strike price. The long put minimizes the risk of losing the paid premium for the option and maximizes the profit to the point of market price that falls to zero. This is a basic strategy with a bearish market view and the opposite of a long call. This is the same as short selling stock with many advantages over it. They include the maximum risk of premium pay and lower investment. It is called an alternative method to short selling for three reasons as it is most attractive and can be used to make a much bigger return on your money. The risk is limited to how much you invest upfront with no margin requirements. We need some capital to make the investment at the outset.

The best time to use a long pull strategy is when you have a bearish outlook and you are expecting an asset to drop in value in a short time frame. The long put is used for buying the put option in anticipation of a decline in the underlying asset. It is used to hedge a long position in the underlying asset. So if the underlying asset fails to put the option will increase in value which helps to offset the loss in underlying. The long put is straightforward as it gets so the purchase of put on the relevant underlying security. You can purchase these contracts through your broker by using a buy to open order. Some factors that should decide are when using this strategy the strike of the option contract, expiration date, and whether to buy European or American style contracts.

There are no hard and fast rules to make decisions because they will depend on your own preferences. Out of the money, contracts are cheap but you will need the underlying security to fall further and make a profit at any money contracts. So choosing an expiration date is a matter of deciding how quickly you think the underlying security will fall in value. Choosing the European or American style contracts comes down to whether you won't pay a higher premium for the flexibility of being able to exercise at any point to expiration.

view moreBuying a put option is a bearish strategy that benefits from a drop in the stock price. This is the same as shorting share of stock except buying puts that have limited loss and low probability of profit. The trader wishes to utilize the right to sell the underlying at a strike price that exercises the option. The stock rises the long put option will expire and the investor will lose the cost of the option. Long put is an investment as ideal for investors who wish to participate from a downward price as it moves in the underlying stock. Before moving further an investor should understand the fundamentals of buying and holding options. This strategy is straightforward as it gets and has one transaction involved.

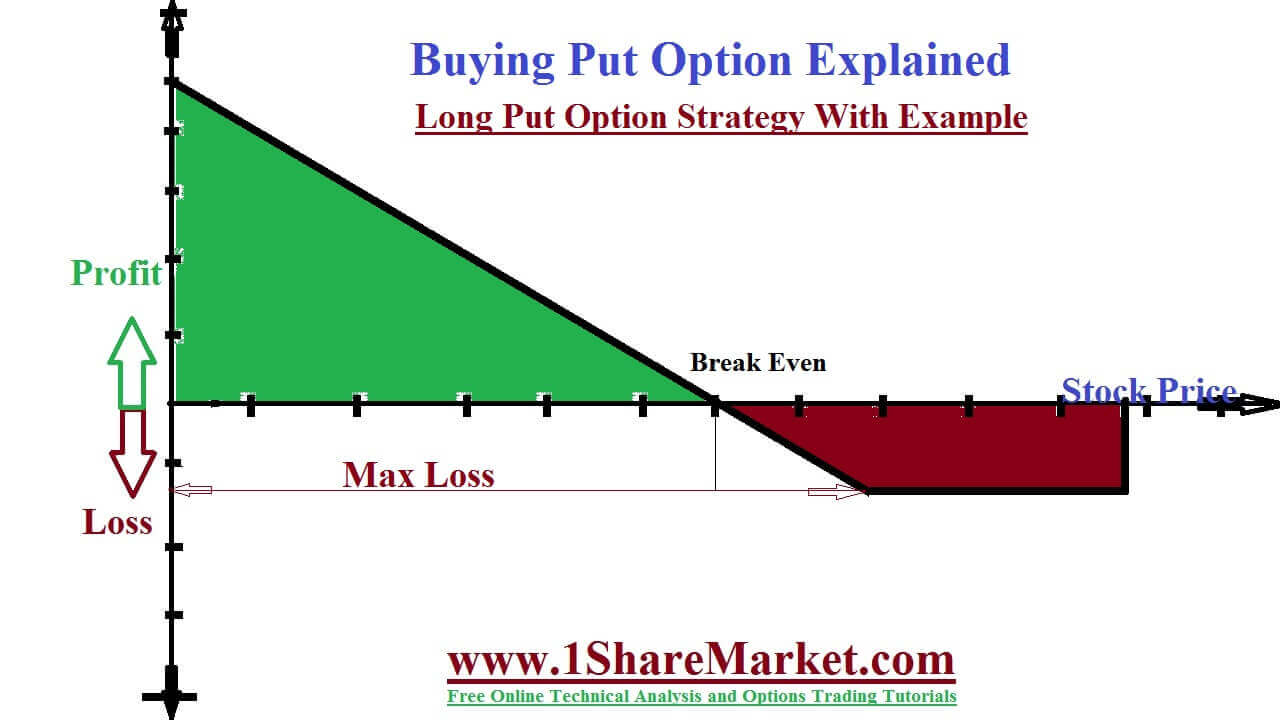

Maximum loss=Net Premium Paid

The maximum gain for the long put strategy is unlimited as the stock continues to move down and gain more and more value at least until it reaches zero.

Breakeven:-

The discount on the long put strategy is calculated by subtracting the premium from the strike price.

Breakeven Point=Strike Price Of Long Put-Premium Paid

The stock of the XYZ company is trading at $40.Then put option contracts with a strike price of $40 expiring in a month's time that is priced at $2. We believe that XYZ stock will fall in the coming week and so you paid $200 to purchase a single $40 XYZ put option covering 100 shares. The right and price of XYZ stock crash to $30 at the option expiration date. The underlying stock price now at $30 your put option will be in the money with an intrinsic value of $1000 and sell it for much. You paid $200 to purchase the put option your net profit for the entire trade is $800.If you fail in assessment and the stock price rallies to $50 that put option expire worthless and the total loss will be $200 paid to purchase the option.

The long put is an investment where the investor will purchase an option that the stock price will fall below the strike price. The long put is an investment practice that allows the investor to wager on the decline of the stock. The investor must handle the potential loss of the entire premium if they are wrong. At times of decline in the underlying price, the trader can earn more throughput ownership compared to short-selling. The risks are uncapped because there is a possibility of the stock price that continues to rise without any limits.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India