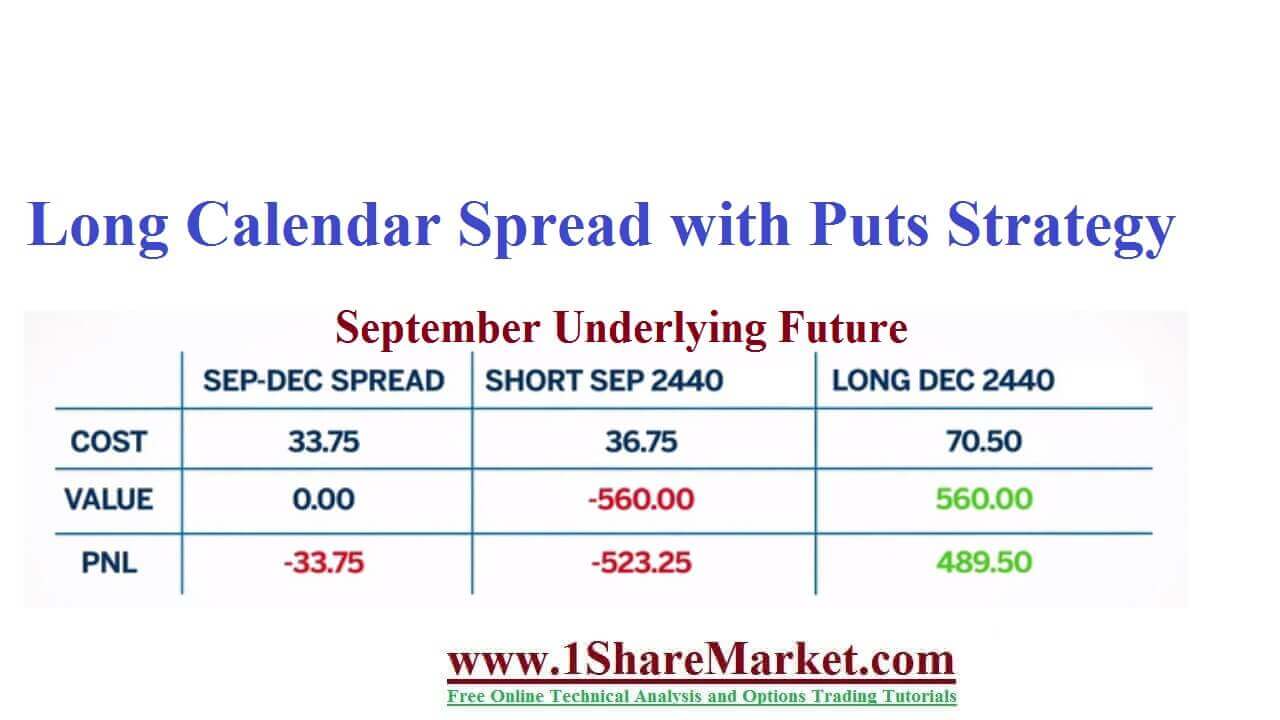

The Long Calendar Spread with Puts Strategy is established for a net debit cost. Here the profit potential and risk are limited. Here forecast can be neutral, bullish, or modestly bearish that depends on the relationship of stock price to strike price after establishing the position. At times when the stock price rises above the strike price, the forecast must be a stock price to fall to the strike price at expiration. If the stock price is below the strike price then the forecast must be for the stock price to raise the strike price at expiration. There is a low net cost to establish a strategy. Also, a high percentage of profit is viewed by traders. They are suitable for experienced traders only who have patience and trading discipline. When market conditions crumble the options are a valuable tool for the investors. The calendar spread is used in any market climate. A long calendar spread with puts is also known as a time spread. It is a position made up of selling a short term put and buying a long term put with the same strike price. The shorter-term put will accelerate the time decay loss value with the expiration approach and there will be nothing at expiration. The longer-term put retains value by selling the shorter-term put that reduces the cost of the trade.

The calendar put spread is the same as the calendar call spread. So both the strategies have the aim to use the effect of time decay to profit from security remaining stable in price. The calendar call spread use calls and this strategy use puts. The establishing of the calendar put spread involves a two-step process. The first step is to use the sell to open order to write puts based on the particular security that you believe and don’t move price. Then you use the buy to open order to buy an equal number of puts based on the same security and have the same strike but one that expires then the one writing.

view moreIf stock price moves in another direction before the short term puts expire then time value spread becomes useless and the trader will lose the premium paid for the trade.

They have two breakeven points as both happen if the stock has a sharp move at high/low before the short-term put expires.

The stock named as ABC is trading at $105 and if we buy a 10. The strike price calendar consists of selling a March call for $3 and purchasing a July call for $4.50.The next cost would be $1.50.If the stock trade goes down to $101 at March expiration, the March puts will expire and the short March puts get removed from the account. Now we are left with long July puts. If the stock goes down to $90 by July expiration then we get a profit of $10 on the puts because we paid $1.50 for the position and our profit will be $8.50. So if we bought the July puts, to begin with, our profit would have only been $5.50.If the stock traded up to $120 by March expiration, the short-terms puts would expire worthlessly, but the longer-term July puts would be far out of the money. They will have no value as the investor could sell out of the positions for pennies. At times when a stock falls to reach $100, longer-term go to zero, and the investor would lose his $1.50 investment. At times when trade slows down to $70 by March expiration. Both sets of puts will be far in the money. They will have the same value made up of intrinsic value. Then the $1.50 paid for the position will be gone.

The strategy is to capture profit through the effects of time decay in your favor when the price of a security is stable, without being badly affected if the price moves. The main disadvantage is that they will affect time decay that is not forecasted with 100% accuracy. This means you cannot predict how much money you might make.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India