Short Straddle Option Strategy will allow traders to make a profit from the lack of movement in the underlying asset than placing directional bets hoping for a big move in higher or lower. The premiums are collected when the trade is opened with the goal of both the put and call expires worthless. The maximum profit is the amount of the premium collected by writing the options. The traders who are an advance run strategy to take advantage of a decrease in implied volatility. The goal of the strategy is to wait for volatility to drop and close the position for a profit without waiting. It passes without movement in the underlying asset that will benefit from time erosion.

The volatility is the main factor and affects a trader profit if it goes up. They are used by advanced traders when the implied volatility goes high for no reason and call, put premium may be overvalued. After selling straddle we wait for implied volatility to drop and close the position at a profit. They will lead to a loss in case of implied volatility that rises if the stock price remains at the same level.

The short straddle is used in two cases as Directional play and Volatility play. It is used in dynamic markets with high fluctuations that result in a lot of uncertainty for traders. The price of a stock can go up/down then a strategy is used called implied volatility. At the time of earning an announcement of the annual budget, the volatility increases the announcement. The trader buys stock in companies that are used to make earnings. They use straddles which increase ATM calls and Put options and make it expensive to buy. Traders need assertiveness and exit when this situation arises.

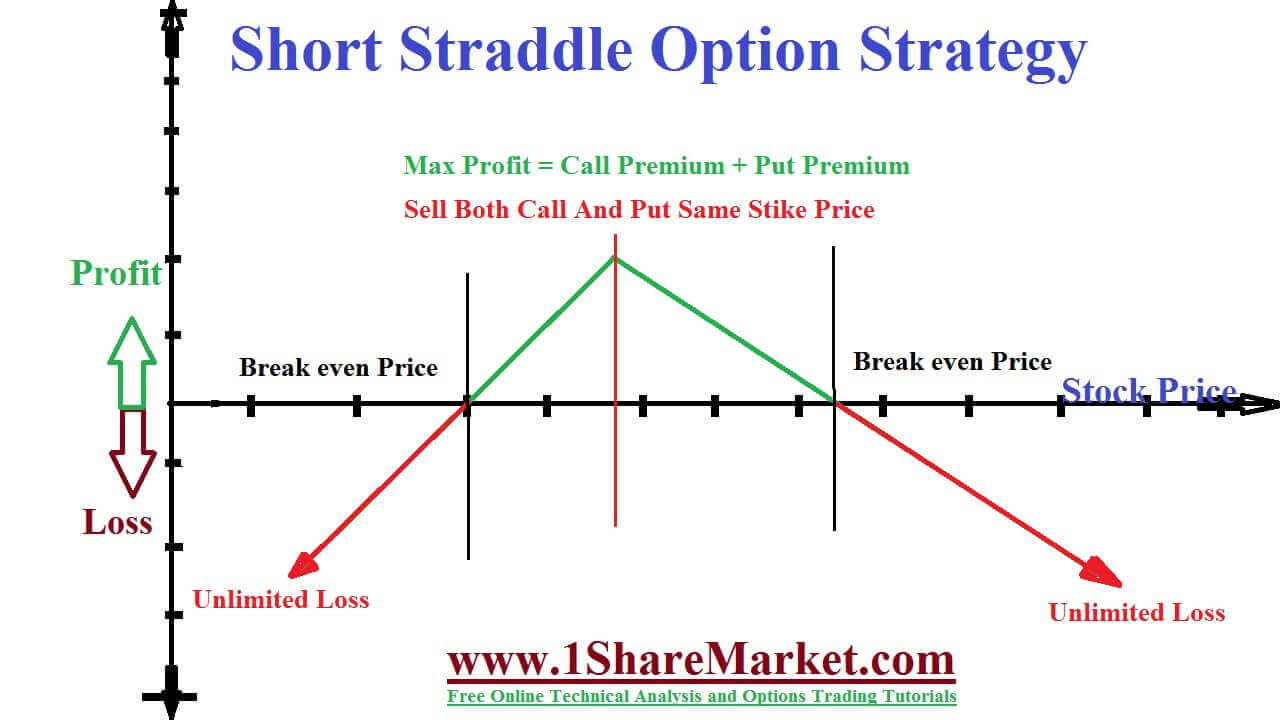

view moreIt is implemented by selling at the money call and putting the option of the same underlying security with the same expiry. It is exposed to unlimited risk and advisable not to carry overnight positions.

If a trader writes a straddle with a strike price of $25 for underlying stock trading near $25 per share, and if the stock price jumps up to $50.The trader sells the stock for $25 if the investor doesn’t hold the underlying stock. He is forced to buy it on the market for $50 and sell it for $25, a loss of $25 minus the premium received after opening trade.

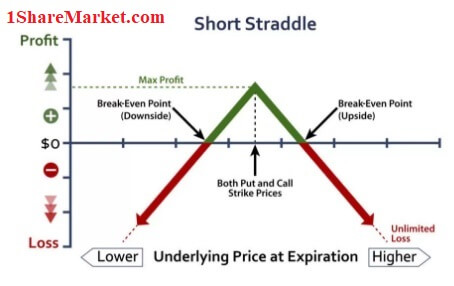

The maximum gain is the same as the net premium received. The maximum loss is unlimited as the stock continues to move against the trader in either direction.

Hereby adding the premium strike price on the downside and subtracting premium from strike price the breakeven is calculated.

The strategy is neutral that makes sense when there is no announcement scheduled. Here trader wants the stock to set stable with less price movement duration. Here they sell that receive two premiums which require the stock twice before they start to lose. The price is for the market except the stock to move it from the current price by expiration. The traders need to be smart and have good timing while executing the trade.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India