Short Call Option Strategy involves a call option that obligates the seller to sell a security to the call buyer at a strike price. It involves risk but requires less upfront money than a long put. The selling call option is legal to buy an underlying asset at a fixed price in the future. The strategy has a limited profit if the stock trade goes below the strike price that is sold and exposed to higher risk if it goes up above the strike price sold. They have uncovered calls consisting of selling calls without taking a position in the underlying stock. For the new member using should avoid the short call option as it is a high-risk strategy with limited profit. More advanced traders use a short call to make a profit from a unique situation where they receive a premium by taking risks. The investors open a these strategy when the prediction for the underlying assets is bearish to neutral. So while making a sale the trader has an obligation to sell the stock at the strike price if the buyer of a short call exercises the option.

The seller of a call option is betting that stock will not increase over a specified price before the option expires in exchange for collecting a premium. The trade is placed when a stock has already a big run to the upside over a short period and technical indicators as RSI. After selling a short call the trader is obligated to the option buyer and guarantee that they will deliver stock to the buyer of the call option if the stock goes over the strike price. If the stock price stays low under strike price the short call option holder keeps the entire premium as profit. And if the stock price rises above the strike price the long call holder will force the short call holder to go out into the open market to buy the stock at the current market price. It will deliver to them at a lower price.

view moreIt can be used when you expect the underlying asset to fall moderately. It is useful if the underlying asset remains at the same level. It is because the time decay factor will be in approval of the time value of the call option as it will reduce over a period of time. A short call is good to use because it gives an upfront credit that helps you to offset the margin.

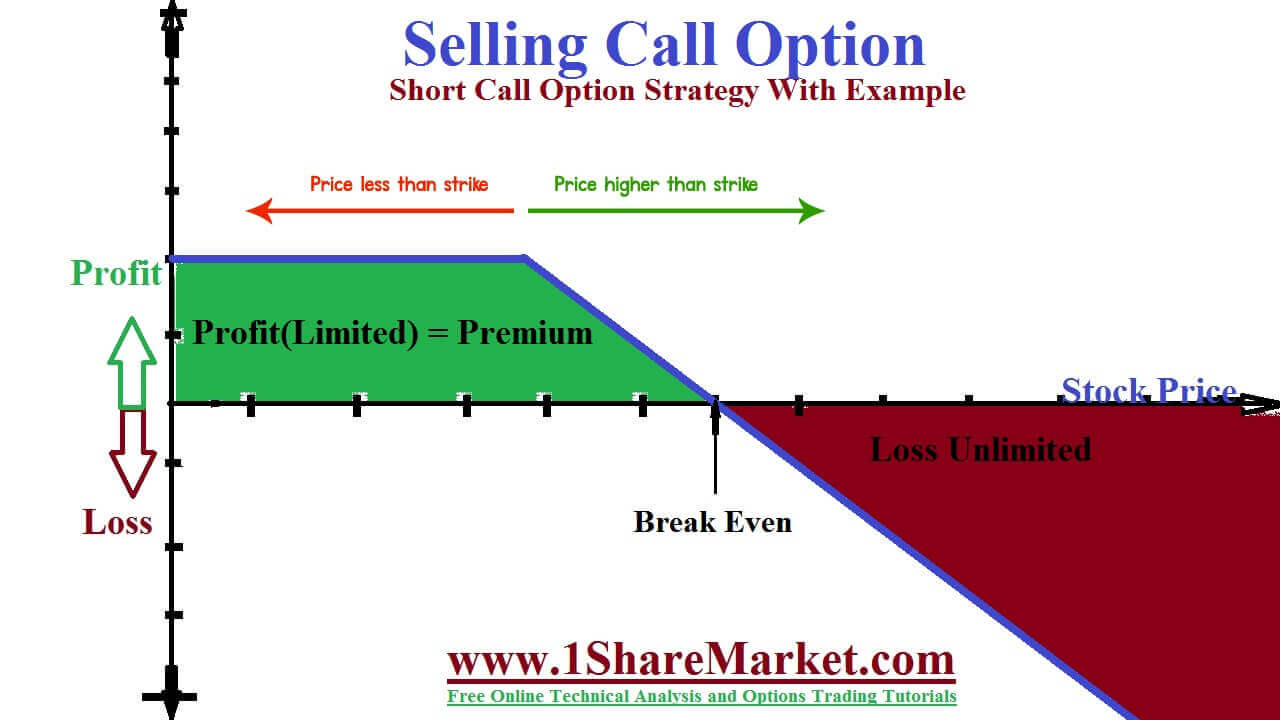

Maximum Profit = Net Premium Received

The maximum loss is unlimited as the stock can continue to move higher with no limit.

The calculation of breakeven short calls is done by adding a premium to the strike price. So if a stock is trading at $100 and the investor wants to sell it at 110 calls for $2.00. The breakeven would be $112.00.

The ABC is stock, trading at $100 if the investor wants to sell it at 110 strike price the call option collects a $2 premium. The stock trader goes up to $115 as they are forced to buy the stock at $115 and deliver to the call buyer at a price of $110 losing $5 in the process. Because the option seller received at $2 when they sold the call their net loss is $3.The stock continues to trade down till $110 as the trader keeps $2 premium as profit.

The short call option is the best strategy for experienced investors who want to capitalize on selling volatility when markets are overbought. As time goes the premium received decays and allows investors to keep the whole premium or repurchase it later for a lower price. At beginning the traders should not use this strategy because it is dangerous as the maximum loss is unlimited. Investors like to sell call index options because they are considered to be less volatile compared to individual stocks.

The potential for profit with this strategy is low due to the unlimited risk involved if stock continues to rise. Traders will sell calls because possibility of getting profit from it is high so an option is out of money and the time of trade is correct. So if an investor is expecting a stock to trade back down they should consider a bear call spread. This strategy will give an investor an ability to profit by selling premium also allows them to lose if they are wrong in their analysis. These strategy helps to generate regular income in a falling market. They will not carry risk because it is not suitable for beginner traders. It is not good if you expect the underlying asset to fall in a short period of time so one should try a Long Put strategy.

© 2020 All rights reserved My blogs (Posts) and videos is only educational purpose on stock market and depend on my self research and analysis. I can't advice to buy/sell any stock. because I'm not SEBI registered.If someone wants to inter the stock market, then my advice is first learn from an authorize institution or take advice from your authorized adviser.

Design by

Sraj Solutions Pvt. Ltd. Additional Services : Refurbished Laptops Sales and Servise, Python Classes And SEO Freelancer in Pune, India